It’s worth examining your premiums with the existing bank in your loan research. The non-public loan application process which has a bank may take more time when compared to on the internet lenders, but banking institutions demand fewer charges and infrequently have competitive desire fees.

1 proportion factors, assuming you qualify. LightStream doesn’t demand any charges, like origination expenses. Some disadvantages contain a large minimum amount credit history score requirement of 695 and The dearth of the prequalification possibility.

You may use a private loan for nearly any function. These are typically many of the commonest explanations to get a private loan:

Precisely what is a Share-Secured Loan? Pluses and minuses A share-secured loan, generally known as a financial savings-secured loan, is a type of personal loan which is secured by the money in your bank or credit union account.

Qualifying for reduced APRs requires a robust credit profile, nevertheless you may constantly use again immediately after bettering your credit history rating.

A HELOC is a house equity loan that works extra like a charge card. You are specified a line of credit rating that can be reused as you repay the loan. The desire amount will likely be variable and tied to an index like the key charge. Our residence fairness calculators can response various issues, like:

Permit’s dive into what helps make a design loan the top for your preferences and which banking institutions stick out in furnishing these providers.

Desire charges are increasing resulting from monetary coverage intervention responding to superior inflation charges. The higher curiosity rates cut down combination desire as less customers have a loan, which ultimately can lead to disinflation and lessen inflation anticipations.

As a substitute, lenders make use of the credit rating, revenue, financial debt amount, and a number of other aspects to determine whether to grant the private loan and at what curiosity level. Due to their unsecured mother nature, personalized loans usually are packaged at reasonably greater desire costs (as higher as twenty five% or maybe more) to mirror the upper danger the lender usually takes on.

Whilst your personal home isn’t at risk should you don’t shell out again an unsecured loan, you could still be sued by a debt collector.

The ideal place to get a personal loan will depend on what you’re trying to find. There are actually three kinds of economic institutions offering own loans:

When you have honest to fantastic credit history, own your website house and want to acquire decreased premiums, Most effective Egg’s secured loan option is really worth taking into consideration. You’ll back again your Best Egg secured loan with fixtures from your home like cabinets and lights in Trade for decreased premiums that may result in major price savings.

Through the use of our loan comparison Device over, you can find honest lenders that can help make your money targets, a fact.

Getting a $35,000 loan with poor credit history may very well be doable, but lenders are unlikely to provide you with their most favorable phrases. The curiosity price may very well be increased than ordinary, and also the repayment expression may very well be brief. Ensure you are able to manage the payments just before signing the loan settlement.

Scott Baio Then & Now!

Scott Baio Then & Now! Barry Watson Then & Now!

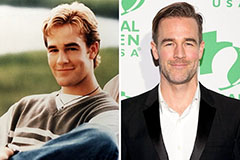

Barry Watson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Batista Then & Now!

Batista Then & Now!